Matt Yglesias has a good post discussing how Iceland defied the conventional wisdom and still did better than countries like Ireland (which is arguably the country that had the most similar economic crisis.) Matt says Iceland did 4 things:

1. Let the big banks fail.

2. Reject austerity.

3. Devalue and embrace inflation.

4. Use capital controls.

I’m going to argue that Iceland did three important things:

1. Let the big banks fail.

2. Embrace austerity.

3. Promote strong NGDP growth, after a stumble in 2009.

I’m not an expert on Iceland, but am anxious to learn. I realize that it’s so small that the data can be very hard to interpret, and that any lessons may not carry over to larger countries. But I still think there might be some useful lessons here, at least for smaller European economies. Here is some data I found for Iceland’s NGDP:

2003 1633

2004 1838

2005 2049

2006 2399

2007 2769

2008 3187

2009 3078

2010 3255

2011 3498

2012 3716

2013 3871

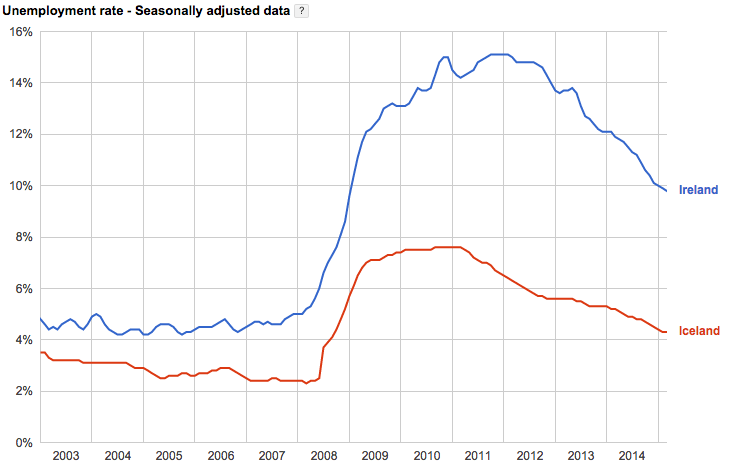

Obviously NGDP fell in 2009, just as in the US. But Iceland had a far more severe crisis than the US. It’s reasonable to assume that without monetary stimulus (which led to high inflation and a sharp devaluation) the NGDP in Iceland would have fallen more sharply, as it did in other small crisis-ridden countries. Also notice than NGDP bounced back really strongly. Of course growth was even stronger before the crisis, but arguably Iceland was in an overheated boom prior to 2008, so (just as in Estonia and Latvia) it’s not clear where the trend line is. Small countries are much more susceptible to random shocks. Matt’s post shows that the unemployment rate did better than in Ireland:

Matt Yglesias says Iceland rejected austerity, and supports the claim with this graph:

Sorry, but I don’t see it. The crisis caused the debt to balloon, presumably due to the big cost of paying off depositors of failed banks, and the effects of the recession itself. But then Iceland started reducing debt as a share of GDP, from 101% to 86.4% in just three years. That’s much better than the US and UK, which supposedly had austerity. The budget deficit in Iceland was 7.8% of GDP in 2009, but only 0.9% of GDP in 2013–better than the US and far better than the UK. So if the US and UK practiced austerity, what’s so different about Iceland?

I see capital controls as a side issue, and don’t know enough about the situation to comment. But the key decisions were clear. Try to prop up NGDP growth with an expansionary monetary policy, rather that wasteful fiscal stimulus, and don’t rescue the banks. It didn’t work perfectly (Iceland had a recession) but it probably cushioned the blow relative to other small countries that were tied to the euro, and hence did not have the flexibility to prop up NGDP. Boosting NGDP can prop up the labor market even during periods when RGDP is falling due to unavoidable shocks.

I said that whereas Matt Yglesias saw four key factors, I saw only three. To be honest, there’s really only one key factor. It’s the NGDP, stupid. Talking about a major business cycle without mentioning NGDP is like talking about the Cleveland Cavalier’s prospects for pulling off the greatest upset in NBA finals history without mentioning their “small” forward.

READER COMMENTS

Kevin Erdmann

Jun 10 2015 at 1:30pm

Yes. How many banks would have even had liquidity crises if NGDP had been stabilized?

It’s a shame that the worst of the monetary policy decisions came right after the Lehman failure, so that Lehman will forever hold an outsized place in the consensus narrative.

Slightly off topic, it’s crazy how much ink has been spilled on regulatory responses, and overnight repos, as far as I know, still have the same legal framework. We should make repo buyers get in line with all the other creditors.

E. Harding

Jun 10 2015 at 2:58pm

“It’s the NGDP, stupid. Talking about a major business cycle without mentioning NGDP is like talking about the Cleveland Cavalier’s prospects for pulling off the greatest upset in NBA finals history without mentioning their “small” forward.”

-Scott, what about severe financial crises such as Indonesia’s in 1997-8, when NGDP never moved below trend? You mentioned they exist in a comment of yours in 2011, but you never really discussed them in depth.

marcus nunes

Jun 10 2015 at 3:20pm

The Iceland story is a “classic” MM story:

https://thefaintofheart.wordpress.com/2013/03/05/ice-ire-supply-demand-shocks/

Scott Sumner

Jun 10 2015 at 5:04pm

Kevin, Good points.

E. Harding, There is no question that financial crises can occur without NGDP falling. I don’t recall the exact data for Indonesia, but that may have been one of those cases. As I recall they had a fixed exchange rate prior to the crisis, and lots of dollar denominated debt. A poisonous combination.

Iceland would have had a recession even with perfect monetary policy.

Marcus, Yes, and you and I have both done previous posts on this over the years.

Shane L

Jun 10 2015 at 5:57pm

Ireland’s debt to GDP ratio over the same period has almost exactly the same pattern as Iceland:

http://www.tradingeconomics.com/ireland/government-debt-to-gdp

Chris

Jun 10 2015 at 6:10pm

I never understood why we look at debt to GDP to judge the stance of fiscal policy. Isn’t that just as bad as looking at interest rates to judge monetary policy? Iceland’s GDP was decreasing at 7% in 2009 so it’s debt to GDP was going to increase even with a balanced budget. If you look at actual spending, it was increasing rapidly until 2009 and has decreased since. That sounds a lot like austerity to me.

Scott Sumner

Jun 10 2015 at 8:29pm

Shane, Thanks for that info.

Chris, Good point.

Michael

Jun 10 2015 at 8:59pm

It’s also worth noting the rapid disinflation — back down to normal two years after they let prices soar, and with unemployment falling throughout. No credibility troubles at all.

Tom Davies

Jun 10 2015 at 11:02pm

I am not an economist — but Iceland ran surpluses in all but two of the years before 2008, and the deficits were small (-0.1 and -0.8). From 2008 onwards, every year had a deficit, mostly large.

As Chris points out, they didn’t increase spending, but it looks as though there was a significant fiscal stimulus. Isn’t that rejecting austerity?

http://www.statice.is/?PageID=1269&src=https://rannsokn.hagstofa.is/pxen/Dialog/varval.asp?ma=THJ05911%26ti=Public+sector+accounts+2000-2013++%26path=../Database/thjodhagsreikningar/fjarmal_opinber/%26lang=1%26units=Billion%20ISK/percent

Public sector accounts 2000-2013

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

Precentage of gross domestic product

Net operating balance

General government 2.2 -0.1 -0.8 2.3 6.3 8.5 7.8 -10.1 -7.8 -8.5 -5.0 -3.2 -0.9

mico

Jun 11 2015 at 12:02pm

Why did he choose a graph of debt to GDP rather than deficit to GDP to present data on austerity? Smells fishy, like he knew the most obvious graph to pick didn’t support the claim.

Tom Davies

Jun 11 2015 at 10:27pm

@mico — I suppose it depends on the definition of austerity — does cutting spending, but cutting taxes more, count as austerity?

Mark A. Sadowski

Jun 12 2015 at 7:39pm

https://thefaintofheart.wordpress.com/2015/06/12/is-iceland-krugmans-inadvertent-case-for-the-monetary-policy-offset-of-fiscal-policy/

NM

Jun 13 2015 at 8:20am

Scott

Regarding the comparative employment performance btw Iceland and Ireland, must it not make a big difference that pre-Crisis, Ireland had a massive real-estate bubble, i.e. employed very large numbers of people in what turned out to be the wrong activity, but Iceland did not? They probably partly financed real-estate bubbles elsewhere, but did not do them at home (i.e., outsourced their bubble, too?). So they maybe had a less extreme labour misallocation to sort out post-Crisis. Since you can’t just re-deploy redundant real-estate workers overnight (or even maybe over-year) you would expect differential employment performance, surely?

Nicholas Martin

Jun 14 2015 at 4:18am

It is also interesting to compare the interest Iceland and Ireland pay on their debt, esp. since Ireland has higher debt levels than Iceland (~122%, 123%, 110% in 2012-2014)

10 (5) year bonds

Iceland: 7.4% (7.2%)

Ireland: 1.7% (0.66%)

Recall that the rates Iceland is now paying were considered unsustainable crisis rates heralding the breakup of the Euro when the Euro-Peripherals were paying them a few years ago.

One might be tempted to conclude that contrary to what *some* say, being in the Euro actually reduces austerity: it allows you to finance higher debt levels at far lower interest rates, thus allowing you to space out fiscal adjustment.

Sources: Eurostat (debt levels), Investing.com (interest rates)

Comments are closed.