After pegging the Swiss franc at 1.2 per euro for a period of about three years, the Swiss National Bank suddenly revalued the franc sharply higher in January 2015, in a surprise contractionary move. They also cut interest rates sharply, a near perfect (and very rare) example of NeoFisherism in action.

In the months leading up to the revaluation, the SNB had accumulated significant foreign reserves, as it sold francs to speculators who (correctly) anticipated that the Swiss would revalue. The SNB was worried about the risk associated with an excessively large balance sheet. What if all those euro and dollar assets fell in value? Might the SNB become insolvent?

At the time I warned the Swiss that they were making a mistake, although in fairness this is a mistake made by many people, even many economists. Here’s the problem. In the short run, a revaluation takes the pressure off the franc. It’s value moves closer to what speculators see as “equilibrium”. But equilibrium also depends on future monetary policy. And a revaluation makes Swiss policy even tighter, reducing trend inflation in Switzerland to a level below that of other developed countries. This just makes the Swiss franc an even more attractive asset to hold. People like to hold Swiss francs because Switzerland has a near 50-year history of one currency revaluation after another. The revaluation in 2015 validated those expectations, and led investors to anticipate more of the same.

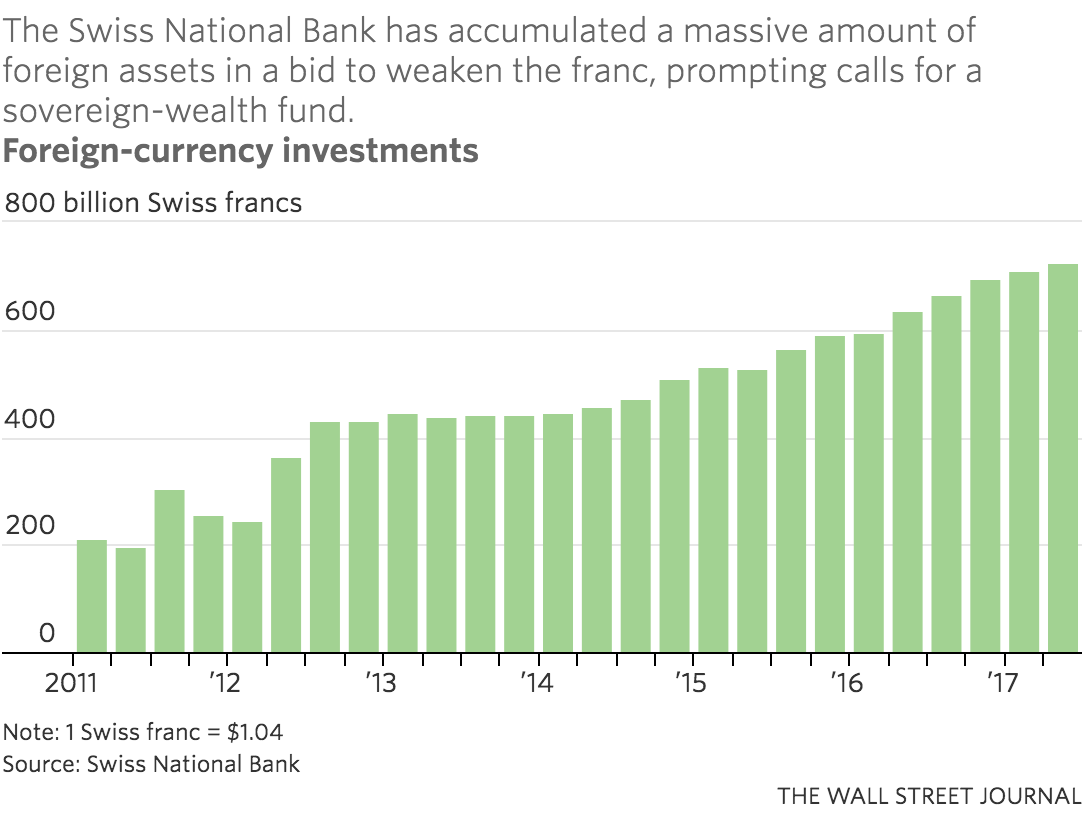

So who turned out to be right, me or the SNB? Based on this graph (and WSJ article) I’d say that I was right:

Notice how the SNB balance sheet was fairly stable during much of the currency peg period, before rising in the months before the revaluation. It was that increase that triggered concern at the SNB, and led to the revaluation. But it didn’t work, the balance sheet has expanded massively over the past 2 1/2 years, just the opposite of what they wanted, but exactly what I feared would occur.

At the time of the January 2015 Swiss revaluation, the Danish krone was under speculative pressure for similar reasons. Many thought they would be forced to revalue. I claimed that no central bank is ever forced to revalue, and Tyler Cowen suggested that the outcome in Denmark would provide evidence as to whether the Swiss were actually forced to revalue (as many claimed) or simply chose to revalue—as I claimed.

The results are in and the Danes did not give in to speculators—they continued to peg the krone to the euro at a fixed rate. But wouldn’t they have to buy up lots of foreign assets to do this? For a brief period the answer is yes, but over the longer run they were able to buy far fewer assets than the Swiss. Look at the Danish central bank’s balance sheet:

Notice that the Danish central bank’s assets rose sharply in early 2015, during the period of speculative fever, but then retuned to normal once the speculators were convinced the Danes were serious about maintaining the euro peg. That’s what the Swiss should have done.

There are many broader lessons here. ECB head Trichet was critical of Bernanke’s QE programs during the period around 2010 and 2011, and preferred a tighter monetary policy. But in the long run this led to slower NGDP growth, and the ECB has been forced to massively expand its balance sheet as a result.

Remember, the slower the trend rate of NGDP growth, the lower the level of nominal interest rates, and the lower the opportunity cost of holding base money. This means that conservative central banks will end up with really large balance sheets. I have called this the “socialism or inflation” dilemma for conservatives. The WSJ article mentions that the SNB already owns about $150 billion in equities, and that there is political pressure to move some of the other $600 billion into domestic investments.

READER COMMENTS

Thaomas

Aug 7 2017 at 5:26am

I do not understand why “socialism” (central bank ownership of equities) a) necessary — especially for a small economy are there not an almost infinite supply of foreign exchange denominated debt instruments to buy? or b) is so bad — as long as the amount of domestic equities remained an insignificant part of total market capitalization.

Scott Sumner

Aug 7 2017 at 11:59am

Thaomas, That may be correct, but of course it doesn’t contradict the point of this post. My point is that conservatives perceive a problem with a big central bank balance sheet.

Lewis

Aug 7 2017 at 2:47pm

You killed it Scott. I don’t understand why big hedge funds and such aren’t trading on this kind of logic. Maybe they are, but are they all just keeping their knowledge of this logic a secret?

Thaomas

Aug 8 2017 at 5:57am

Seems like a great research topic for PoliSci-Econ research to figure out the sources of resistance to sensible monetary policy whether NGDP or PL targeting.

Are there arguments in the Fed’s reaction function in addition to prices and employment (e.g. rates of change of future ST interest rates or size of the Fed balance sheet that do not work through prices and employment)? Or does what looks to you like suboptimal policy come out of a different model from the one you would use.

If there are extra- dual mandate arguments, where do they come from? Cui bono? Or cui thinks that they bono?

Scott Sumner

Aug 8 2017 at 2:55pm

Thanks Lewis.

Thaomas, I see lots of cognitive illusions out there, where people rely on gut instincts, not logic.

acemaxx

Aug 9 2017 at 4:07pm

Scott, we may not forget that SNB’s high level of FX are not net wealth. They have been financed by (newly) created CHF, through money creation.

Thus, SNB’s FX investments differ fundamentally from the asset of SWFs, which have been financed through oil exports.

Comments are closed.